Managing all the details of your relocation program is hard enough, but adding the complexity of relocation tax gross ups is a whole other ball game.

Don't worry, we've got you covered!

Managing all the details of your relocation program is hard enough, but adding the complexity of relocation tax gross ups is a whole other ball game.

Don't worry, we've got you covered!

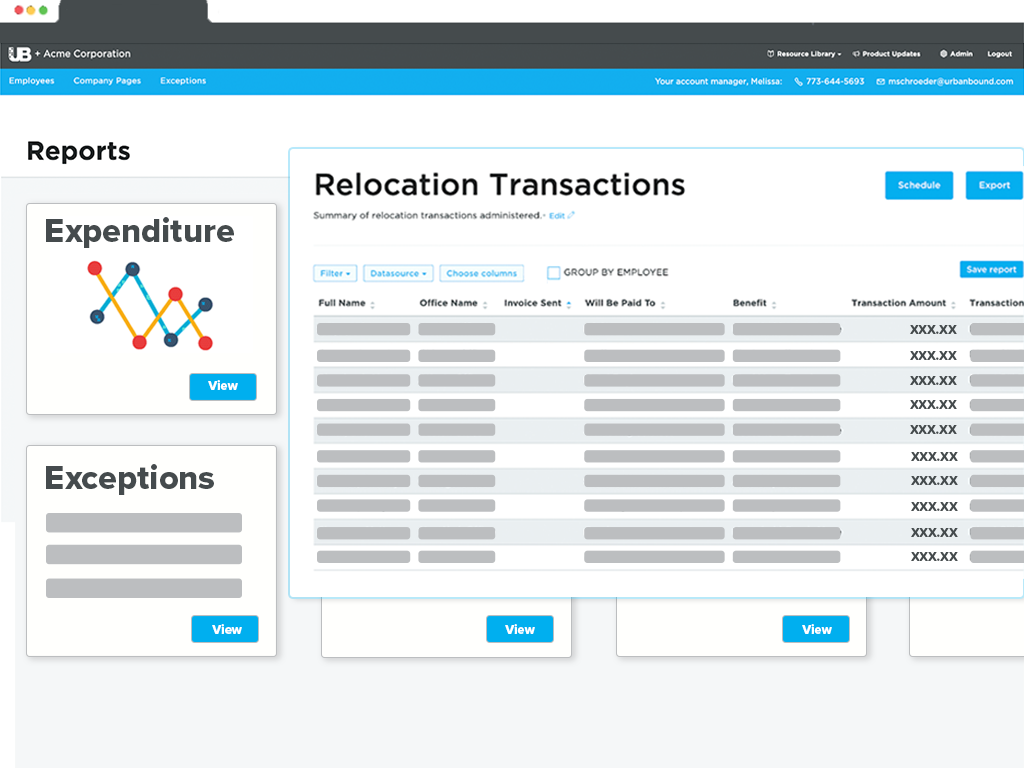

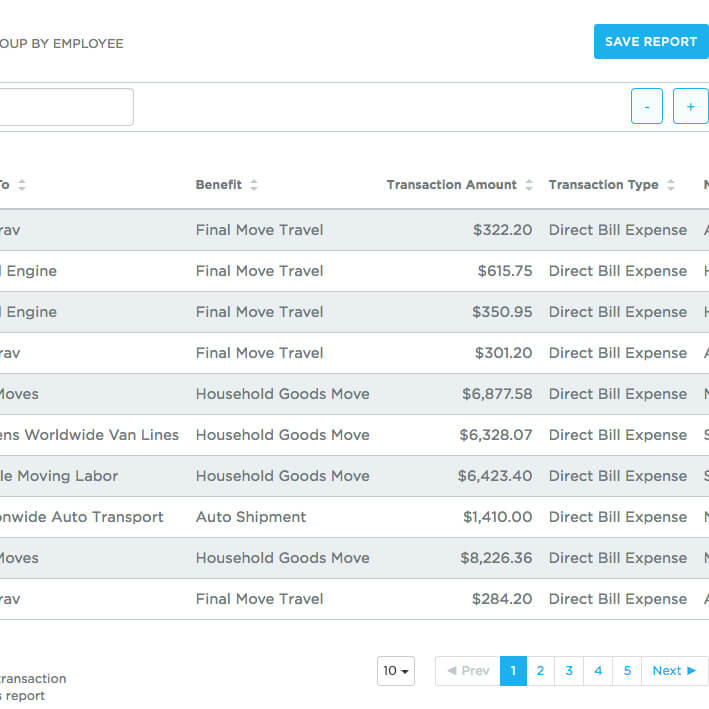

UrbanBound’s relocation software, combined with our relocation tax consultation service, helps streamline the gross-up process and manage all relocation expenses in one central location—from direct payments and cash disbursements to gross-ups. Easily view, analyze, and export payroll reports in the format and frequency needed by your team.

Easily get the data you need from the one place that houses all employee relocation spend, from pending transactions to incurred expenses and tax calculations.

Keep payroll processes running smoothly! No matter if you are grossing up all, some, or no expenses, UrbanBound can support your company relocation policy and manage gross-up calculations based on your company's unique needs.

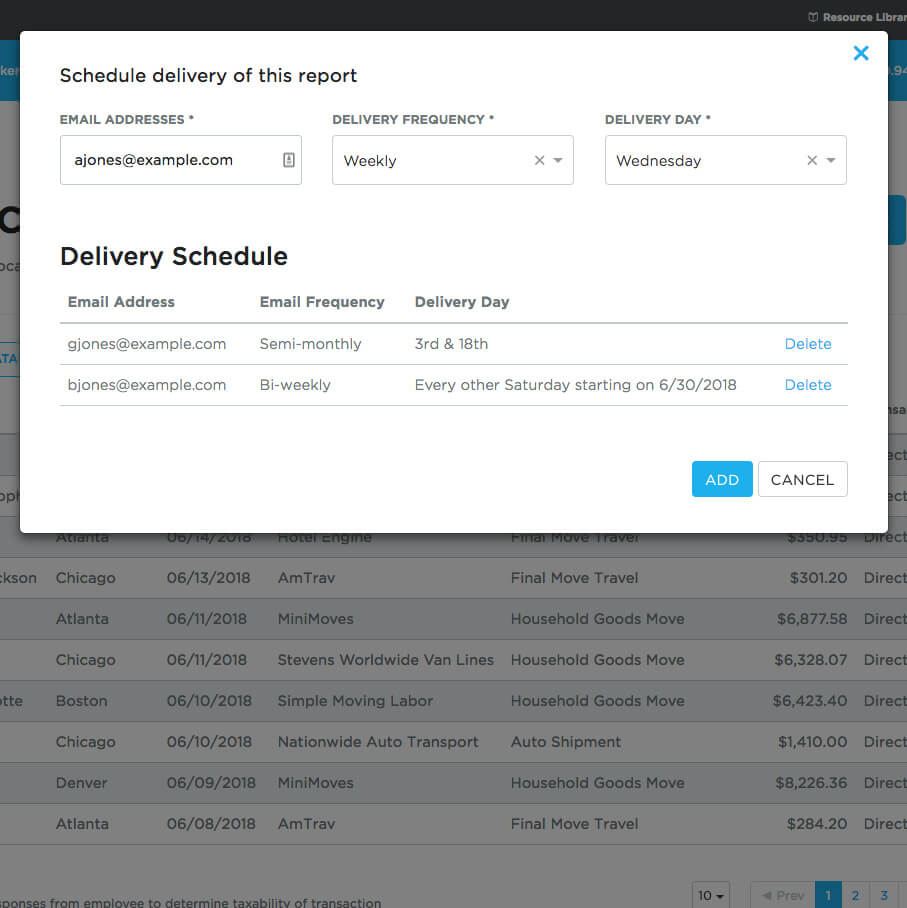

Whether you need reports delivered weekly, semi-monthly, bi-weekly, or somewhere in between, UrbanBound helps you get the reports you need when you need them, in a format that works for your internal systems.